Stargazing

#CapitalAtRisk

x/10

The future is unknown and unknowable. Everything changes. This is of course where the big rewards lie and therefore as an angel investor you somehow have to make decisions about founders and their businesses that will hopefully position you well for this uncertain future. Investors often talk about the importance of having the right ‘investment thesis’ when looking at businesses. That’s all well and good for defining the stage, sector and industry of the business you’re evaluating, but what about the founder? Do you need a thesis when it comes to evaluating people?

Early in 2020 I came up with the ‘Star Founder Matrix’. I’ve spoken to a few people about this in the last couple of years so it’s time to get it down ‘on paper’ in case it’s useful for other angel investors to read.

In 2019 and early 2020 I had done a lot of reading and thinking about Star Businesses, first shown in BCG’s ‘Growth Share Matrix’ and expanded upon in Richard Koch’s terrific book, ‘The Star Principle’. What is a Star Business? Essentially if you’ve found the leader or potential leader in a fast growing niche and that niche can get very big and it can be defended, invest! I’ve become a total convert to the Star Principle. So that got me thinking, could there be a similar matrix to evaluate and categorise founders rather than businesses?

For years I’ve ‘scored’ the founders I’ve met (as in, really scored them — marks out of 10 on a big spreadsheet). Doing this I tried to answer questions like: What is the likelihood of the founder being successful? What does winning look like for them? Why are they doing this? Why now?

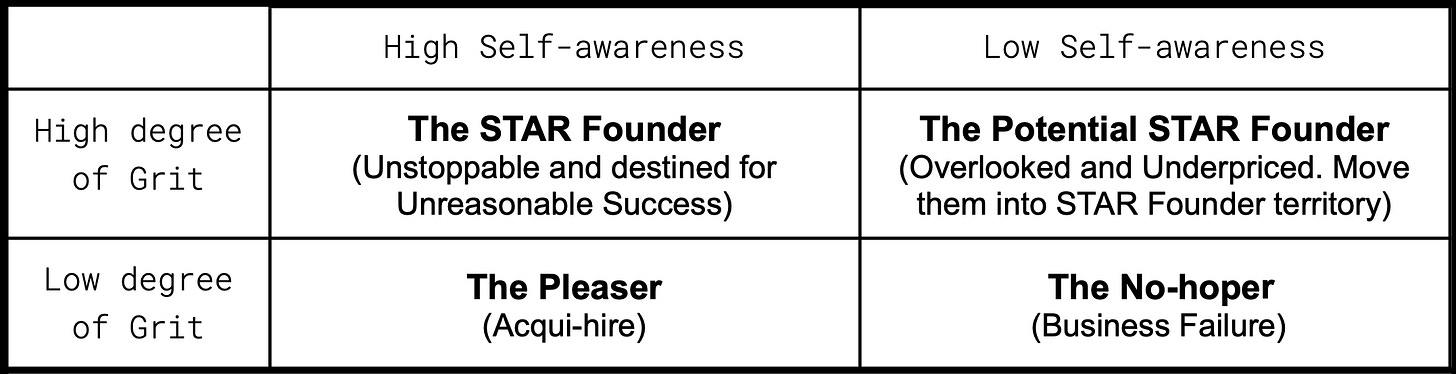

Thinking through those questions after meeting thousands of founders year after year has enabled me to develop the Star Founder Matrix, below, and allows me to categorise and place the founders I meet.

Star Founders

I am defining a Star Founder as a founder with a high degree of Grit and high Self-awareness.

Star Founders have a high degree of Grit, which keeps them going when the going gets tough and they have high Self-awareness, by which they truly know themselves and this allows them to focus on the right tasks and make the right decisions.

Grit: Find a way that works

Most people quit. The guaranteed result of starting a startup is that this will get difficult. All founders will want to, and be under huge pressure to, quit. Grit — sheer bloody stubborn mindedness — will keep a founder going during some of these dark times.

Often there’s just no way around it: When the going gets tough, will the founder you’re thinking of investing in find a way that works?

Self-awareness: Know thyself

Does this founder know what they’re good at and what they not good at? Are they deluded? Can you figure out why they’re doing what they’re doing? Do they themselves know?

We’ve all seen people on the X Factor who, after being rejected by the judges, tell Simon and the gang that they’ll work harder than anyone else and come back and show them that they’ll be a star. The thing is they’re tone deaf. They may have grit but they don’t have self-awareness1.

Chris Sacca talks about sensing the ‘inevitability of success’ — the founders that know deep in their bones that what they’re doing will be successful. These founder are often misunderstood — they’re the F1 driver for whom the thought of crashing just never enters their mind — all at once they can mistakenly be seen as too humble, too arrogant, too quiet, too passionate, too fast, too smart and a bit slow. They’re all of that but they also know, they just know.

Through the telescope

Evaluating founders is hard so how can you find these stars? People are complex and irrational. They say things they don’t mean and do things they said they wouldn’t. They have things going on in their life that you don’t know about. They’re masking the real problems in their business by telling you about superficial ones you’re more inclined to hear about.

So how do you get to the truth, whatever that may be?

A new word to me this year was quiddity. That’s what I’m seeking, uncovering and interested in. Quiddity, when it comes to founders, is not just who you know. It’s what you know about them — what makes them them.

After almost 10 years of hosting meals with 9others that’s the word for what I’ve been seeking: quiddity. I’m not here to convince anyone one way or another, just to observe, acquire unique insight and get towards the truth.

And the goal?

To invest in Star Founders who are building Star Businesses of course. What a thing that would be.

In other news

Unplugged is one of my portfolio companies and they’re raising investment right now. If you want to find out more, ask me anything or see their pitch just email me by hitting the button below:

What is Unplugged? They lock your phone away in an off-grid cabin so you can completely recharge. They’ve had over 98% occupancy this year and you can read more about them in the Daily Mail here.

And you can book an Unplugged stay here.

Important:

None of these posts are investment advice. If you are thinking about investing you should seek the advice of a suitably qualified independent advisor.

#CapitalAtRisk

I’d still dearly love to be a Formula 1 driver. But, even with all the grit in the world, I realised some time ago that this sadly isn’t going to happen.