Hosting, Meeting, Writing

I currently have ‘skin in the game’ in 15 companies. I’ve also had one exit and five failures. I think I’m a better investor because I have listened to founders and asked them questions at meals with 9others for the last 10 years. It’s at 9others that I try to discover their quiddity. And I think I’m a better listener and questioner at 9others because I’ve made some investments.

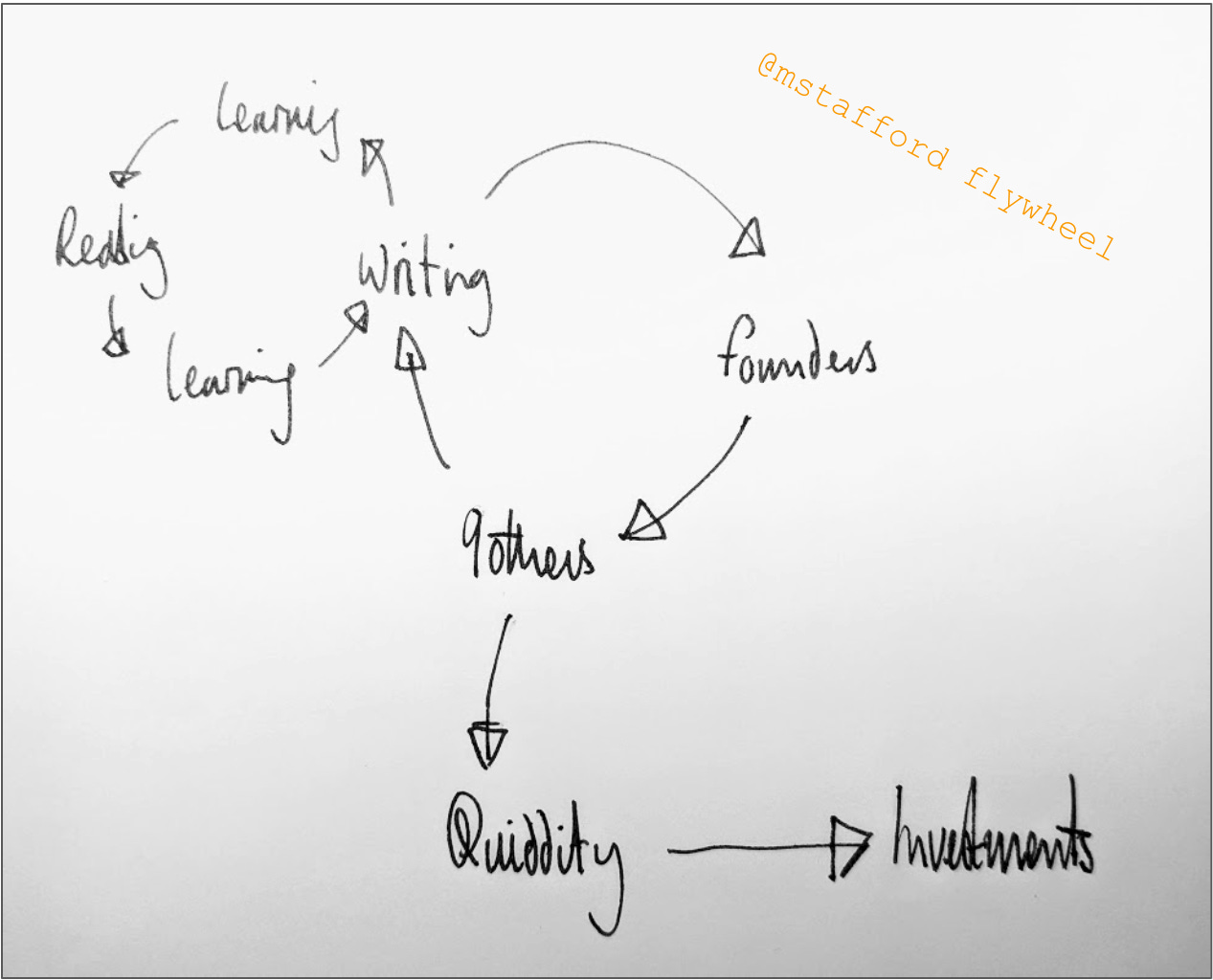

Hosting a simple meal with 9others each month drives everything I do and, when it comes to angel investing, I don’t think there’s a better flywheel for meeting and evaluating founders that then surfaces investment opportunities.

In the past I often thought that what I do is like spinning plates — hosting meals with 9others, building and maintaining my network of relationships, a bit of consulting, a bit of investing… But the thing about spinning plates is that the plates aren’t connected. Each activity can feel disjointed or irrelevant to each other.

With a bit of adjustment these things can be better connected — a flywheel. Get that humming nicely and it’ll throw off some amazing opportunities — all my investment opportunities come through 9others, the founders either come to a meal or are introduced by someone who’s been.

Mine is not yours

While hosting meals with 9others is at the heart of my flywheel, it won’t be at the heart of yours. But what could be? If you’re stuck for ideas, think about what you can contribute and the channel to share that — start a newsletter, a podcast, or even a Slack channel, maybe write your first book. Make sure you optimise for feedback though — as I said at the top, it’s listening that makes me better — that’s how I’m able to spot trends and potential Star Founders early.

Just keep spinning, just keep spinning…

The hard bit is getting it going. That takes the courage to start something new, then you have to get up to speed and it can then take years before anything of value is thrown off.

But stick at it. Once it’s going it’ll hum nicely with low input but massive potential output and who knows, maybe you’ll spin up another in tandem.

Don’t expect quick results though. And that’s the point.

In other news

As we celebrate the 10-year anniversary of 9others, I have been sharing more content about the insights we gather and ponder at 9others (the latest piece is here). I hope it’ll be useful for entrepreneurs, investors, and anyone else with an interest in the challenges of modern business.

From February I will be starting a new 9others podcast series. Each month I will talk to someone from the previous month’s meal with 9others about their challenges and opportunities and the decisions they might make to move forwards.

You can listen to the first 9others podcast series here.

Important: None of these posts are investment advice. If you are thinking about investing you should seek the advice of a suitably qualified independent advisor.

#CapitalAtRisk