AMA

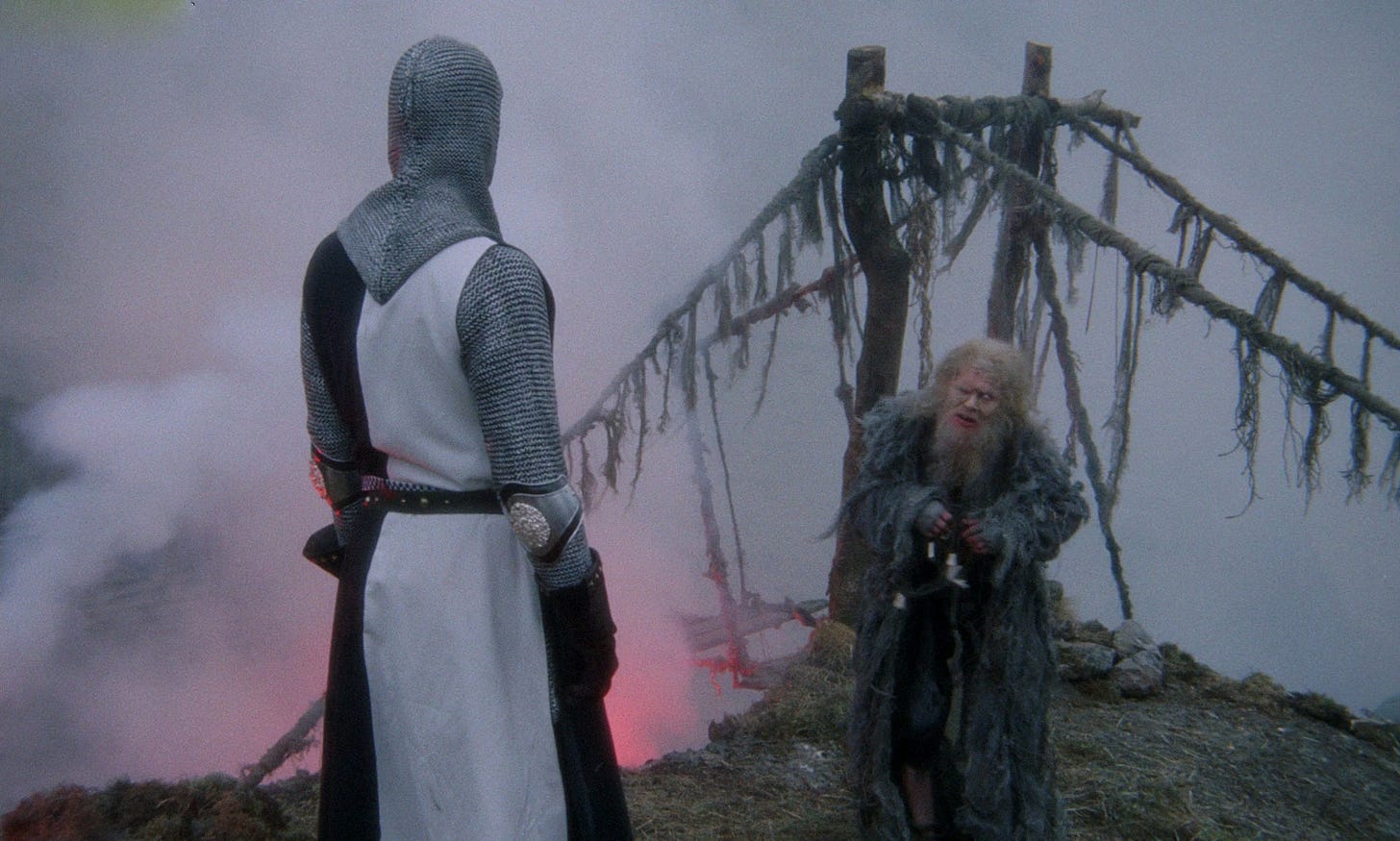

We don’t want to make it quite as dramatic as crossing the Gorge of Eternal Peril but as an angel investor one has to ask the right, and sometimes difficult, questions.

As I’ve written about before angel investors ought to seek the truth, even if they don’t like what they hear or are uncomfortable with a sometimes candid conversation.

Answer me these questions three

I recently invested in Seep. You may remember Laura from this Q&A we did last year. Fast forward to June this year and Laura came to a meal with 9others during which I discovered (unsurprisingly) that Seep is doing rather well. Laura was wondering about raising an SEIS round.

In the run-up to investing and in amongst other DD and thinking I asked Laura the following three questions:

What is your thinking when it comes to an exit?

What is one thing that — come hell or high water — you will refuse to compromise on?

If the company was to fail, why will it fail?

For each in turn here’s what I’m trying to get at:

Yes, there are many reasons for investing in startups but never forget that Venture Capitalists are in this to make money. By asking about the exit I want to know roughly how much money the founder wants to have and when. At this stage I'm not thinking about who buys the company or the overall price — I'm more interested in the founder’s number (everyone has one, right?) and when they want that by1.

When I analyse startups I try to peel away all the layers, I want to get the buzzwords, the spin, the fancy features and big words out of the way. After all that stuff is gone what’s left behind should be the *why* — why this founder is doing what they’re doing2.

Most startups fail. This gives a clue to discovering where the founder thinks the big risks are. Do I agree? Do I think they’re avoiding something3?

It’s a two-way street

Be warned though — asking candid questions is all very good but don’t be like the Bridge Keeper in the above film: If you get a question about your question the very worst answer is “I don't know that”…

And with that, if you have any questions to send my way please hit reply and fire away.

Bonus: I recently did an AMA with HeyDay, “Matthew Stafford Discusses Angel Investing,Running In-Person Events, and Growing his Community 9others”.

You can read the Q&A here.

Important: None of these posts are investment advice. If you are thinking about investing you should seek the advice of a suitably qualified independent advisor.

#CapitalAtRisk

Getting the founder’s number — the amount of money they personally want to walk away with — allows you to get an insight into their grit and self-awareness. Some founders with less than 10% equity at the seed stage have told me they want a very big number so, given future dilution, the exit price would have to be in the many billions of pounds. Is that achievable? If, on the other hand, that founded had started with, say, 80% equity at the seed stage then to hit their number the exit could be much lower. Is that good because it’s more likely or not ambitious enough? Neither is right or wrong but their personal number gives you vital information.

Top tip: If a founder says they can’t possibly answer this question because “there are just too many”, they take too long or give you a long list of non-compromisable things then I’d wonder not only about their core motivation but also their ability to focus.

Asking a founder what their biggest challenge is is always a good question. However that question often gets a quick-thinking and pretty standard answer. Often we avoid the biggest issue by masking it with other ‘challenges’. A few why, why, why questions can help.