The 2010s was the decade of the Entrepreneur. The 2020s will be the decade of the Investor.

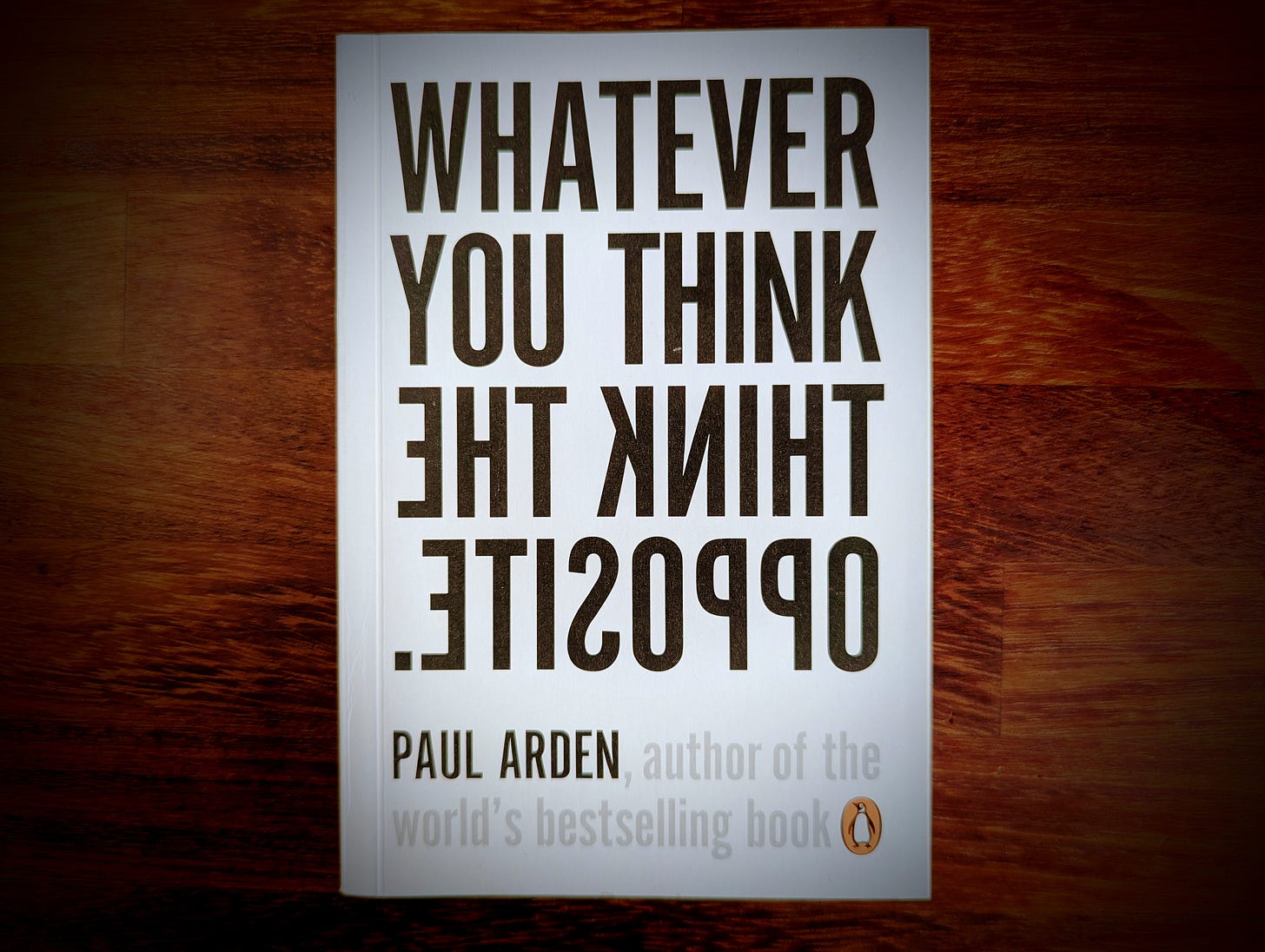

“It’s not because you are making the wrong decisions, it’s because you are making the right ones.

“We try to make sensible decisions based on the facts in front of us.

“The problem with making sensible decisions is that so is everyone else”.

Paul Arden

Welcome to new subscribers…

🆓 Free subscribers get a short preview and all free public posts. NB: All posts in 2024 will have paid-subscriber-only parts.

💰 Paid subscribers get access to all posts, the angel investor Q&A podcast I did during the 2020 lockdowns, the full archive and can request a video call to ask me anything and talk about the things I don’t share anywhere else.

💰💰💰 Founding Members get all paid benefits plus you get to WhatsApp me unlimited questions for discussion, you get a one hour discussion session once a quarter plus a great lunch (most likely in London) on me.

Thinking differently

Consider the following…

Founders need a warm introduction to an investor

If you can’t be bothered to write a few hundred short, personal emails then perhaps you’re not cut out for this.

Cold emails are vastly underrated.

Not a mass mail-merge though.

Keep it to two lines, max.

Be conversational.

There’ll be a bit of copying & pasting but there must be a few extremely relevant words for the person you are writing to.

Say, “Thank you for…” rather than “I would like…”.

In fact don’t start more than one sentence with “I”.

Never start an email with an apology.

Treat the email with the right amount of ‘lighthearted gusto’1.

The objective is to get a reply, not to give chapter & verse on business, life and everything else.

And aside from all that, the chances are a few dozen cold emails can be written while waiting for that one warm intro.

A founder needs a co-founder

If a founder has the right network and the right mission then perhaps they can do all that as a solo founder.

Or at the very least there needs to be a ‘boss’. A typical 50/50 ownership could cause more problems than it solves, for example indecisiveness or decision-by-committee.

Of course founders will need help and trusted counsel every now and then, so they should have a network of different types of people: An op’s guru, a sales guru, a marketing guru, a coach that pushes you. You could even pay them for their time so you all take it with the seriousness it deserves — could a small retainer to half a dozen people be better than giving away 50% of your company?

And some inspiring examples:

Sara Blakely. Used $5,000 of savings to develop the prototype and launch the Spanx brand. Sara became a billionaire in 2012 when she was featured on the cover of Forbes magazine as the world’s youngest self-made female billionaire at the time.

Travis Kalanick. Travis was the undisputed boss of Uber once it was clear it was going somewhere. When facing a challenge I often say to founders, “What would Travis do?”. Watch this, which is from when ‘UberCab’ was one of Travis’s many side projects.

Mark Zuckerberg. Yes, he had ‘co-founders’ but Zuck had 65% of the shares at incorporation. Could he have done the whole ‘move fast & break things’ without that?

Michael Dell. Started with $1,000 and was selling PCs from his dorm room. He became a billionaire at the age of 31 and has a net worth of $124 billion as of March 2024.

Nick Wheeler. Started Charles Tyrwhitt as a mail-order company in the 1980s while at Bristol University. He loves the company, never wants to sell the company and sold £269m worth of suits, shirts and ties in 2023.

Always have a pitch deck ready

A short memo is better than a deck (just ask Jeff Bezos2). Everyone reads a deck. Only the truly curious and serious read the memo (and they’re the ones you actually want to read it).

It’s a filtering thing. The objective is to get the right people to come along with you, not to get a deck in front of as many people as possible no matter who they are.

Related: A simple website (or none at all) could be better than one that tries to explain everything you do. The following is from a founder I met up with recently who has a vague one-page website they just haven’t updated in ages:

“We've also found, a bit weirdly, that the being obscure has added some mystery which has been quite helpful. It's meant that people have had to sit down and listen / discuss rather than skim read a landing page and dismiss”.

Get publicity, enter your company for lots of awards

Firstly, the very best work doesn't get awards, at least not in the early days. Awards are awarded on consensus and when looking at the truly original and innovative half the people will love it and the other half will hate it, or simply won't understand it.

And secondly this allows me to trot out one of my favourite quotes:

“As the old saying goes, all anybody needs to know about prizes is that Mozart never won one”.

Charles Saatchi

Invert, always invert

Charlie Munger is right yet again. You don’t always have to be super smart, you just have to avoid stupidity. Hard problems are best solved when you look at them backwards.

Anyone can add complexity but it takes more courage, not to mention confidence, to subtract and simplify. You might even feel a bit daft for a while.

And it’s not easy. Thinking differently takes time, for me anyway.

It often takes a two hour walk or run. This is really annoying as the breakthroughs can come in just a few seconds of that time — they’re often obvious when they come, “Ding, that’s it!”.

The thing is, though, you need to get through the first hour or so because that’s when all the easy answers come to mind. You need to get those out of the way to get to the good stuff. Keep going.

For paid subscribers

Keep reading with a 7-day free trial

Subscribe to The Education of a Startup Investor to keep reading this post and get 7 days of free access to the full post archives.