When I first worked in the I.T. departments of RBS and then The Bank of New York I was part of the team that built the software that administered the dealing of investment products like Unit Trusts, ISAs and similar. I can admit now that I had trouble getting my head around it all. The software systems, the terminology and all the processes that had to run were pretty complicated. My boss said the best way to learn was simply to buy an ISA. Put a bit of money in it, he said, a couple of grand. By doing that I’d get the various brochures, statements, tax documents and DD forms and would be able to see how it all worked from a customer point if view. And it worked.

I think it’s similar for angel investing. A common misconception is that investors need a vast amount of money to get started and get learning. It doesn't take a big exit, you can pay-as-you-go.

It’s easy to think, “Once I’ve made some money, that’s when I’ll invest — that’s when I can afford the risk”? Fair enough. But the thing is, the risk is always there and you’ll never be completely ready. As with many things this is what makes life interesting and challenging so perhaps you can ‘pay-as-you-go’ now with a bit of spare cash like I did with the ISAs.

If you’re making your way towards writing your first angel investment cheque then there are some things to think about before you start talking to entrepreneurs who, remember, want your money:

By investing in startups you’ll get to hang out with some of the smartest people who want to change the world and you’ll meet them when they have 1-10 employees in their company. But what is it you want from investing? Is it all about money? Do you want to contribute? Will you help these people or just get in the way?

You can be part of a community of other investors but you’ll still have to make your own decisions. Is that what you want? Do you have time for it?

At first glance the list of reasons a startup will fail is very long. And the list of why it’ll succeed is very short. Will you be able to strike the right balance between gut feel Vs hard analysis?

How much will you invest in each company? Most startups fail but if you hit the jackpot with just one then that could makeup for all other losses and be life changing on top.

Is making 5 investments in a year the right number? After three years you’ll have a portfolio of 15. Is that enough for you?

When does this end? Startups fail so investing in just a few then stopping isn’t a very good strategy. What does your ideal portfolio look like? Will you stick with it?

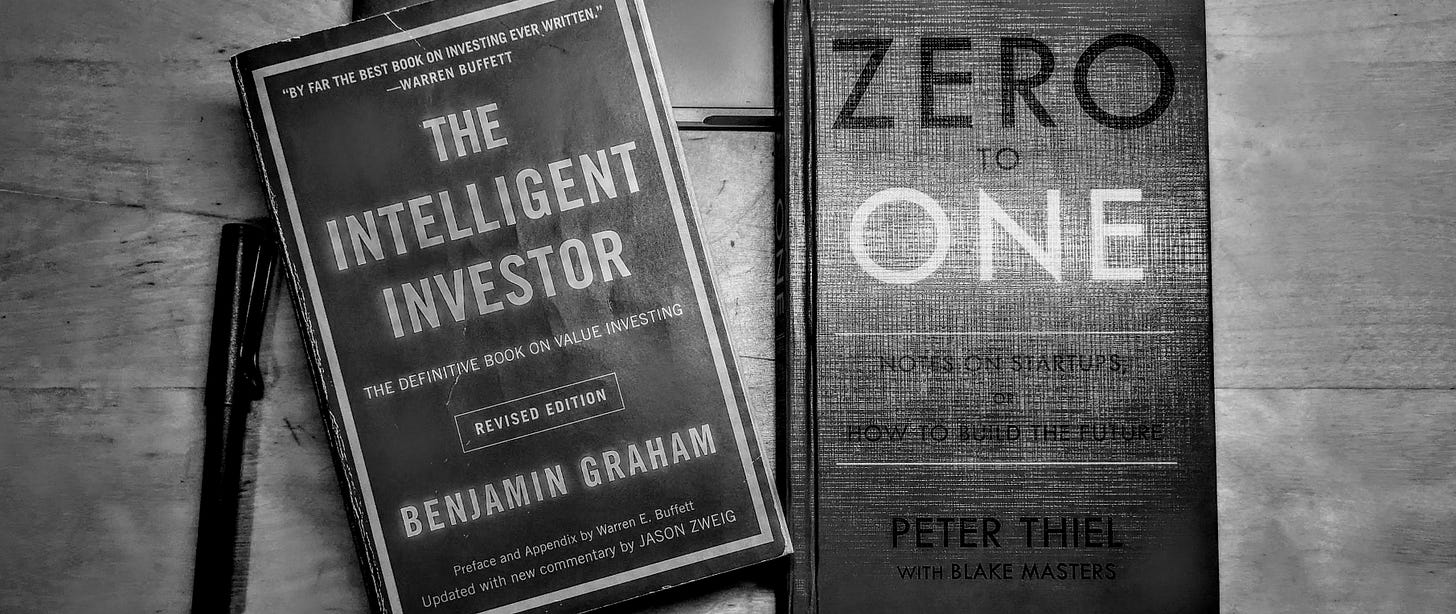

As well as reading the books in my photo above, another good place to start learning is to hear what other Angel Investors like Tim Jackson and Rachel Bell have to say. You can subscribe below and listen to my interviews with them and others. (Subscribers also get my phone number and can ask me anything, anytime).