The 2010s was the decade of the Entrepreneur. The 2020s will be the decade of the Investor.

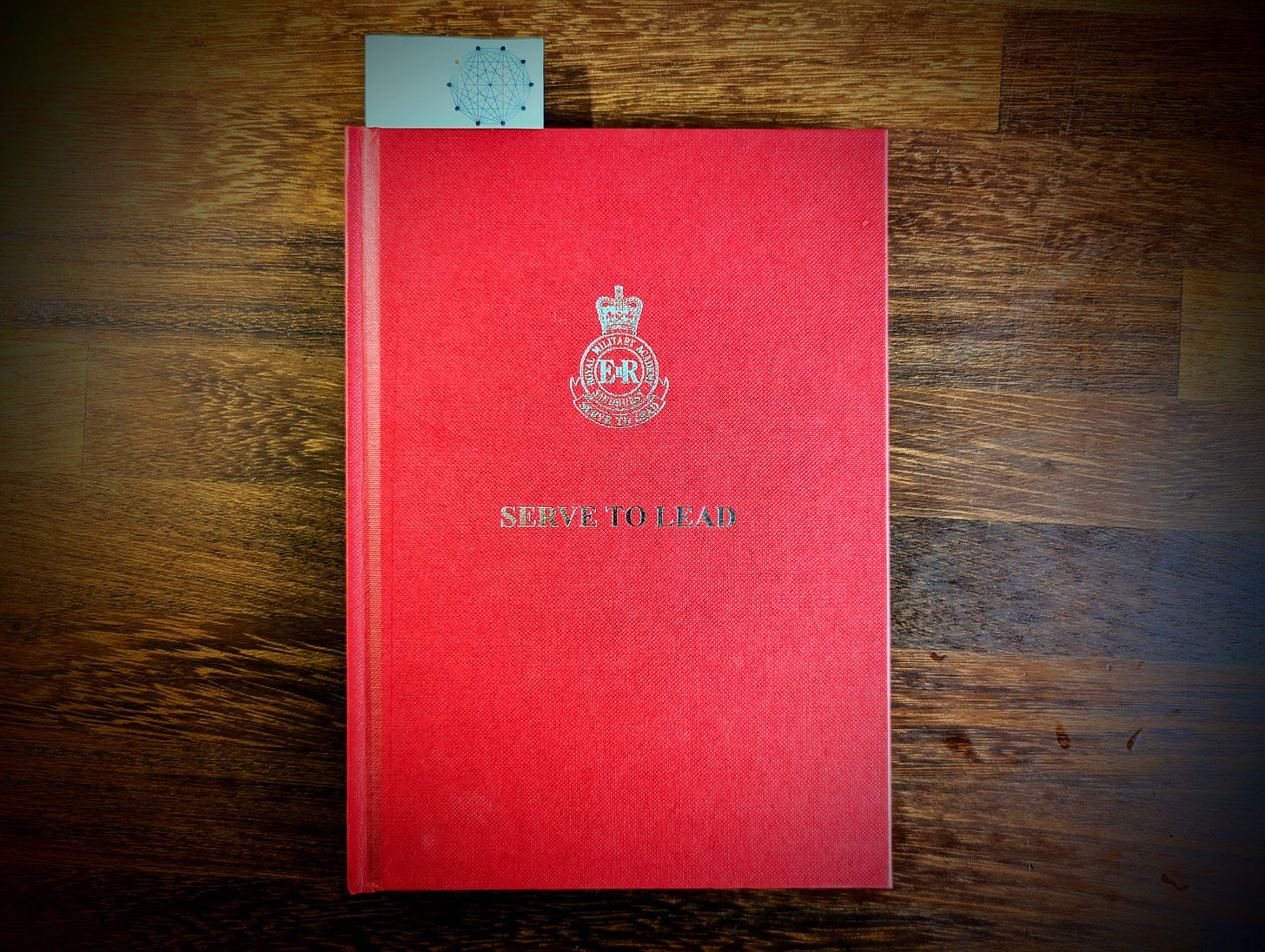

“Ten good soldiers wisely led,

“Will beat a hundred without a head”.

Euripides

Welcome to new subscribers…

🆓 Free subscribers get a short preview and all free public posts. NB: All posts in 2024 will have paid-subscriber-only parts.

💰 Paid subscribers get access to all posts, the angel investor Q&A podcast I did during the 2020 lockdowns, the full archive and can request a video call to ask me anything and talk about the things I don’t share anywhere else.

💰💰💰 Founding Members get all paid benefits plus you get to WhatsApp me unlimited questions for discussion, you get a one hour discussion session once a quarter plus a great lunch in London, on me.

Precision

A few of my portfolio are either fundraising to gearing up to do so. One stood out though…

The founder WhatsApp’d me with the exact details. Along the lines of:

The new share price is £x.

You invested at a share price of £y and have #xyz shares.

So to maintain your stake you’d need to invest £z.

Naturally the first thing I did was multiple £x by #xyz. I got a number over 5x that of the one I got when I first invested just over three years ago. Lovely.

Vs Ambiguity

The above is a lot clearer and more pleasant than the typical story, which goes:

Hey, I’m raising soon, somewhere between £x and £y.

The valuation will probably be around £z.

However I’m just waiting for a lead to set the price.

Perhaps I’m being unfair or unrealistic but in the first case it looks like they’re leading the way, not following the lead.

Keep reading with a 7-day free trial

Subscribe to The Education of a Startup Investor to keep reading this post and get 7 days of free access to the full post archives.