The 2010s was the decade of the Entrepreneur. The 2020s will be the decade of the Investor.

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid instead of trying to be very intelligent.”

Charlie Munger

Welcome to new subscribers…

🆓 Free subscribers get a short preview and all free public posts. NB: All posts in 2024 will have paid-subscriber-only parts.

💰 Paid subscribers get access to all posts, the angel investor Q&A podcast I did, full archive and can request a video call to ask anything and talk about the things I don’t share anywhere else.

💰💰💰 Founding Members get all paid benefits plus you get to WhatsApp me unlimited questions for discussion, you get a one hour mentoring session once a quarter plus a great lunch in London on me.

I’ve started so I’ll finish

Like many of you I typically have a few books that I’m reading on the go at once. Recently that’s been the following:

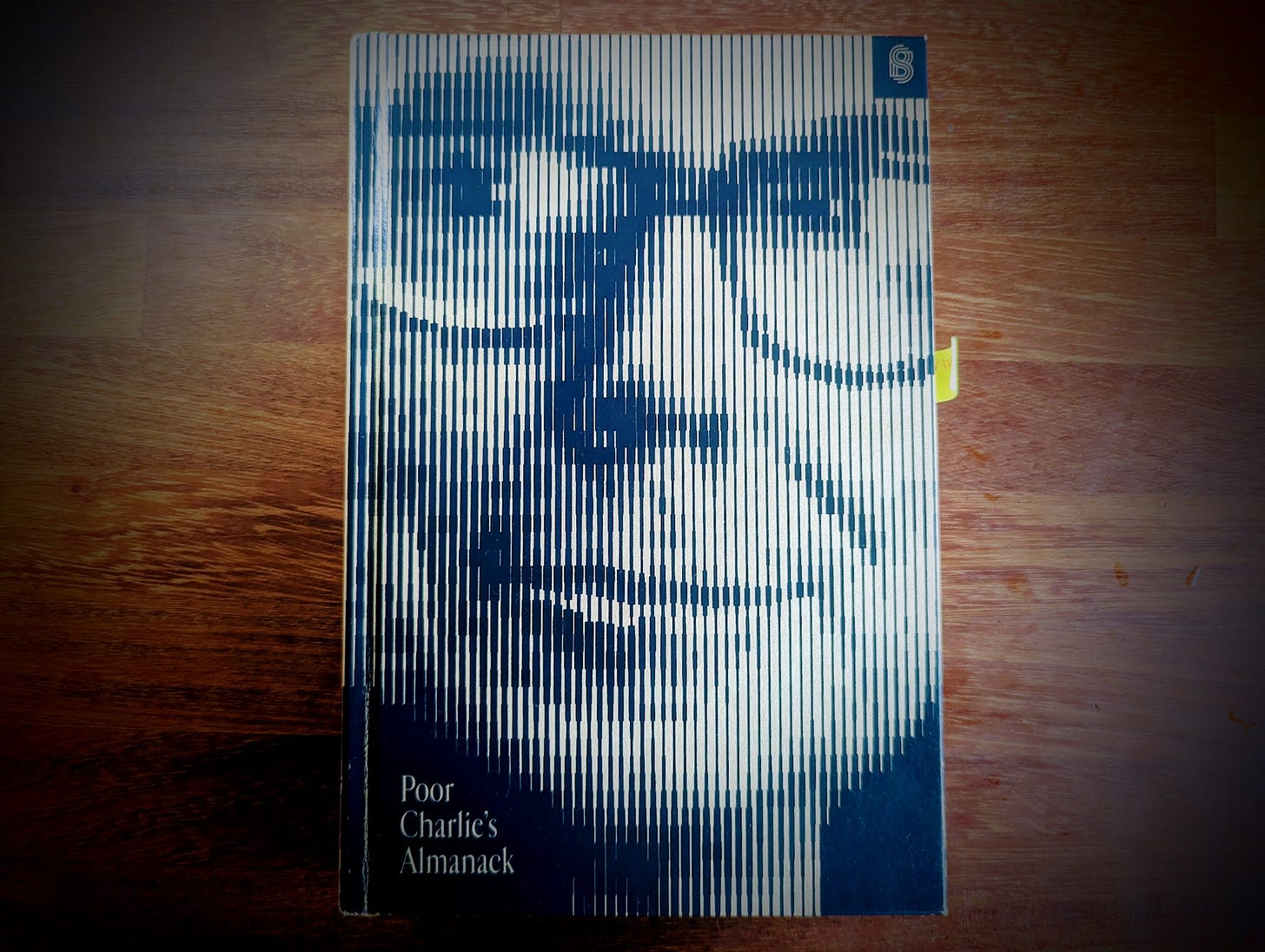

Then a new edition of Poor Charlie’s Almanack, published by the excellent Stripe Press, arrived.

I know you probably know it, but Charlie is just so damn smart. I’ve read a lot about Charlie and Warren Buffett over the last decade or so but there’s no way I’m going to put this one down for any of the above.

Incentives & Inversion

As I shared in 12/52: In with the old... a few weeks ago, I keep listening to what must be Charlie’s most famous speech, ‘The Revised Psychology of Human Misjudgment’. You can listen to Charlie’s speech here and you can read the transcript here.

But what are Charlie’s best lessons that I’ve read so far?

I think it’s that we should always look for the core incentives. I find it remarkable that investors still get carried away without thinking of the core incentives or psychology of founders. Investors read a deck from a startup and their imagination immediately goes into overdrive wondering, “If I was running this startup how would I do it?” or they say to the founder, “Here’s what I think you should do…”.

How I’ve learned from Charlie?

It’s all very well being inspired by Charlie and appreciating the genius of the guy but what have I actually learned that I have applied to venture investing?

Keep reading with a 7-day free trial

Subscribe to The Education of a Startup Investor to keep reading this post and get 7 days of free access to the full post archives.